Last month I wrote about the various types of advisor relationships and the common ways founders engage with their network of advisors. On the back of that article, I received a bunch of questions around what the first group of advisors for a business should look like. So here we go — a deep dive on the ‘Advisory Board.’

As a quick refresher, there are many use cases for an advisory board and you can expect to see value across a number of key areas. Common ways to engage an advisory board include:

- Introductions: Prospects/customers, candidates, investors, other advisors

- Recruiting: Network referrals, interviews, selling the opportunity

- Amplifying the Brand: You may select an advisory board member for her large social following or public persona. If she is a known/respected entity for your buyer, you can build brand awareness and trust through association

- Product/Roadmap Feedback: Customer advisory boards are an entirely different beast, but among standard advisory boards, you might turn to them for an objective view on the market and user needs

- Fundraising: Depending on the length of the relationship, an advisor may be a strong reference or help sell the opportunity during a raise

- Domain Expertise: Industry or functional experience to complement you/your team

While all of these are important and can deliver value, “Domain Expertise” is where we see the most outsized impact. In the early days of a startup, you can’t afford to hire (nor should you) the CMO who has launched 26 products in her career, or the rare sales leader who has seen the full path from 0 to 100M. Instead, you are doing much of the work yourself, and as quickly as possible, hiring a scrappy team — people who are driven and committed, passionate about the problem you are solving, and eager to learn and up-level themselves quickly.

As a founder, you are not, and should not be, the expert on sales, marketing, product, engineering, finance, etc. But the team you have hired needs support, guidance, mentorship, and experts to learn from. You can set the tone for the company and encourage a culture of learning and growth. Enter advisors.

Advisors are 10x-ers. They’re people who can accelerate the learnings of your team, help you see around corners, and bring years of experience to the table.

We recommend thinking about advisors from Day 1, with an eye on the right skillset at the right time and aligned compensation:

- Advisors are not just for the CEO; your entire executive team can benefit.

- You do not need to make a 2-year commitment. Optimize for the skills needed for the next 6 to 12 months, then you can renew or find the next right advisor.

- Plan ahead and dedicate a few percentage points of your employee stock ownership plan (ESOP) to constructing the right team of advisors at each stage of growth.

Now to the good stuff. Who do you actually need?

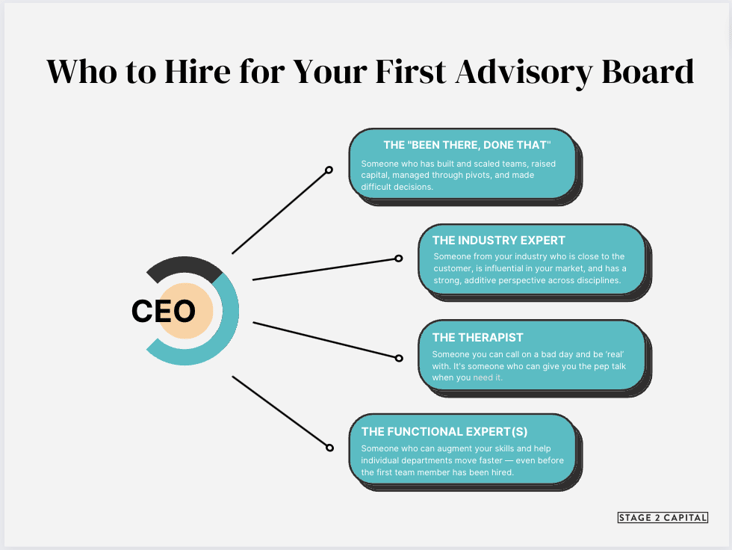

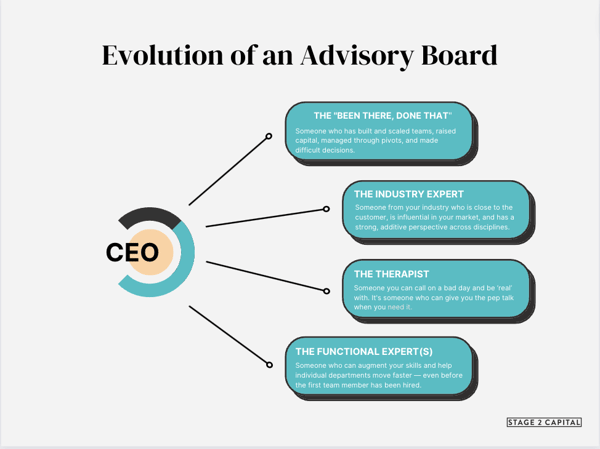

At the nascent stages of the company, the CEO and founders are wearing a lot of hats. The group of advisors we encourage you to look for, fall into a few profile buckets:

- The “Been There, Done That”: A CEO advisor who has built and scaled teams, raised capital, managed through pivots, made difficult decisions, and overall, “seen the movie before.”

- The Industry Expert: Someone who 1) comes from your industry and is close to the customer, 2) is influential in your market, and 3) has strong additive perspective across a few disciplines (likely marketing and product).

- The Therapist: It’s lonely at the top. As a founder/CEO you don’t have a peer in the business and, while you want to be transparent with your team, there are plenty of things you can’t talk about openly. Who do you call on a bad day? Who are you ‘real’ with? Who can give you the pep talk when you need it? Find that person early.

- BONUS: Functional Expertise: See below for details on each department. When you are pinch-hitting to cover each of these departments, you might benefit from a few people who can augment your skills and help you move faster — even before your first team members have been hired.

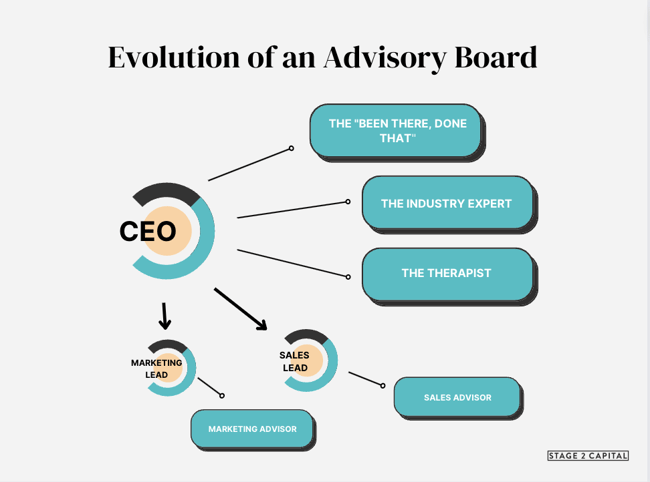

As you hire in departmental leadership, we recommend extending your advisory group to bring in 1-2 advisors PER leader in your org. Here’s how we think about what’s most important to each function:

- Sales: Go senior here. You’re looking for someone who can help set strategy, see a few steps ahead, and coach up your leader. It’s critical that this person has run sales teams with a similar demand generation strategy and GTM motion, but does not claim to have “the playbook” — they need to be ready to bring their experience and apply it to your unique company and situation.

- Marketing: Look for current active skill sets — people who have successfully operated at your stage in the last 3-5 years. Marketing is a likely candidate for multiple advisors to supplement your team based on needs (brand, demand gen, product marketing, etc…).

- Customer Success: Focus on finding broad experience — someone who has overseen onboarding, renewals, support, etc… and can give guidance on how this function builds out over time, including KPIs and hiring profiles.

- Product-Led Growth (PLG): This is still a relatively new discipline, but certain companies have excelled. This is the most critical advisor to a PLG business — go big. Target someone who worked the early days of a very successful company you admire. Pedigree matters.

- Product: We recommend seeking out a product leader who has experience with 1) your end user/end market and 2) a similar GTM motion and user journey (e.g. don’t bring on an Advisor with 20 years of enterprise application experience if you are developing an open source product for developers).

- Engineering: There are 2 flavors here and it comes down to your technical leader. Either look for someone who can coach the founding CTO to hire in the VPE. Or, look for someone who can help the founding CTO grow as a people manager, develop the team, and build scalable practices.

- People: This is potentially the most-overlooked role in an early business, which is ironic given early-stage companies need to hire and onboard many roles on a tight timeline. Often, the early hire in People Operations comes from recruiting, and would benefit from a Senior Advisor who can tackle questions spanning everything from culture and team building, to compensation benchmarking, to compliance.

- Finance & Operations: Fractional or outsourced finance functions tend to be common in the early stages of a business. However, as soon as you bring the function in house, this advisor can be really helpful in thinking through some of the nuances of reporting, fundraising, modeling and cash management.

It’s never too early to start assembling your advisory team. This group should grow and change along with your business. Now that you know who to hire, stay tuned for the next article in our advisor series to learn how to most effectively manage and leverage this group.