“Who will win the go-to-market AI race?”

I’ve been studying this question closely over the last 6 months. I’ve enjoyed countless debates with go-to-market leaders from the largest public companies all the way down to pre-product, pre-revenue startups with talented AI tech teams. More recently, at Stage 2 Capital, we rolled out the Go-To-Market AI Lab to understand and accelerate innovation in the ecosystem. Within a week, 100+ CROs/CMOs/CCOs opted in to evaluate the AI tech we are seeing and 200+ AI startups submitted their ideas with the hopes of meetings, tests, and early customers with these leaders.

We hope in the weeks to come, we can report back on quantitative trends in buyer sentiment, innovation concentration, and early success stories. In the meantime, I’d like to share the anecdotal trends I heard, first about AI in general, and then about trends specific to go-to-market.

GENERAL PERSPECTIVES ON AI TECH

The disruptive potential of AI is much bigger than blockchain, bigger than mobile and social media, and on par with the Internet and electricity

No surprise, people think AI is going to be big. Really big.

Let’s put it in perspective relative to the major tech innovations we have seen in the first quarter of this century. Blockchain has been a bit of a downer, especially with the recent lull in crypto. Mobile was huge, but mostly on the consumer side, as it disrupted major services like taxis, enhanced micropayments, and significantly accelerated the adoption of social media. However, the impacts on the B2B side were less significant. The Internet, however, was a big moment for tech across almost all sectors. It changed our society.

AI is expected to be that big, likely bigger.

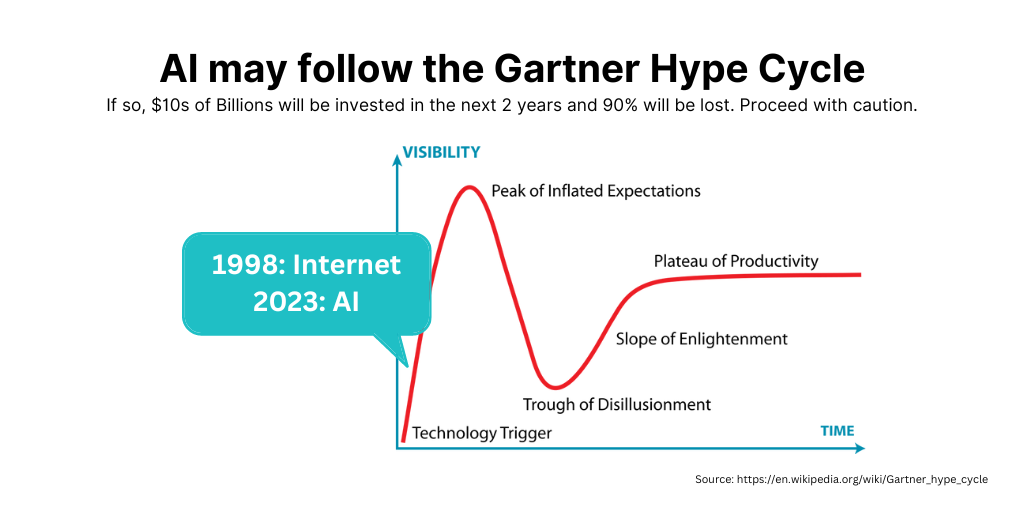

We are in the hype stage of the AI disruption. Over the next few years, billions will be invested and most will be lost

Many people speculate we are in the hype stage of the Gartner Hype Cycle.

AI in 2023 is roughly correlated to the Internet in 1998. In 1998, we couldn’t fully conceptualize the true potential of the Internet. The innovations were incremental rather than disruptive. Most efforts were putting the news or a company brochure online. We couldn’t yet see Uber, Zoom, or Snowflake. Those breakthrough ideas happened after the crash during the “slope of enlightenment” stage.

As an entrepreneur, investor, or corporate strategist, you probably can’t afford to sit on the sidelines with regard to AI. However, pursue carefully. Similar hype signals are being observed today. Startup ideas feel more like iterations rather than true disruptive products. Startups are getting enormous valuations with no product, no customers, and no revenue. We seem to be in the hype phase.

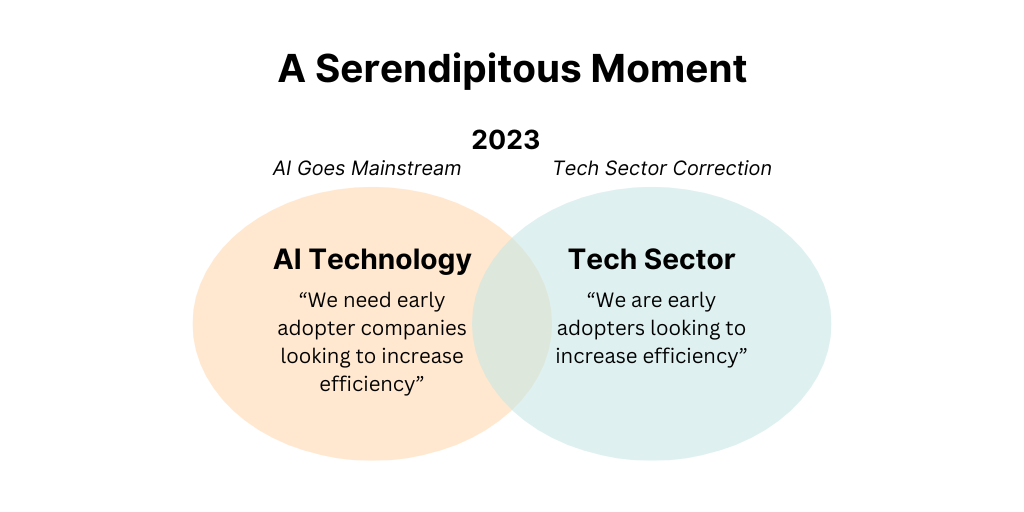

The market correction in tech and focus on efficiency is a serendipitous accelerant of the AI movement

We have experienced a massive market correction in the technology sector over the last 18 months. Strategies have shifted aggressively from “grow at all cost” to “maximize efficiency”. This shift is great for AI as the technology sector is a logical first adopter and the tech sector’s recent focus on efficiency makes AI experimentation and adoption a C-Suite priority. While many startups are leaning away from the tech sector as a target market, hoping that other sectors like hospitality, energy, health care, and finance have fewer budgetary headwinds, AI startups should lean into the sector as an ideal early adopter.

The societal impacts are scary

While this article analyzes what AI technology could do, it doesn’t mean it should. We need to carefully balance AI’s disruptive potential with negative implications for society. The smartest tech execs are most worried about the physical harm AI could have on our species. That perspective is difficult for me to comprehend but it worries me that they are worried.

The economic impact is easier to comprehend. AI could replace many jobs. Research by some of my economist colleagues at Harvard Business School and others at the World Economic Forum indicates that similar concerns over job displacement occurred during technological breakthroughs over the past few centuries. Yet, these breakthroughs often generated more jobs than they replaced. I hope they are right, but it is hard for me to intuitively agree.

I just want to be clear that the insights in this article analyze the disruptive potential of AI but we need to equally way the societal impact. We failed with social media and need to do better with AI.

STARTUPS VS. INCUMBENTS: WHO WILL WIN THE GTM AI RACE?

With the above context set, let’s evaluate this more specific question by analyzing various dynamics influencing the future outcome.

The commonly used seat-based pricing in GTM-Tech may cause an Innovator’s Dilemma for the incumbents. Advantage startups.

The late Clay Christensen’s work, “The Innovator's Dilemma," is an important framework to reflect on at this moment. The work is expansive so I recommend you read up on it yourself. However, one concise summary that I find very relevant to the AI dynamics is the issue large incumbents have with this strategic question:

“Should we make better products to make better profits or make worse profits for people that are not our customers that eat into our own margins?".

Large incumbents often pursue the former which, in times of technological disruption, causes their ultimate demise.

Here is a very specific example in the go-to-market tech sector. Many go-to-market tech platforms, especially CRMs or sales-tech, are priced on a per-seat basis. This pricing model may create an innovator’s dilemma for the incumbents. If an engineer at a large sales-tech company approached the executive team with an idea that would replace many human seats in their customer base with AI, that idea will likely give the team pause. It would take some serious guts for the executive team to pursue that use case, as doing so would likely cannibalize a large part of their business model.

As we embrace AI technology, the large sales-tech incumbents will likely favor AI use cases that do not displace but support existing roles with their job, often called co-pilot use cases. Because of the innovator’s dilemma, they will likely shy away from displacement AI use cases that reduce the number of seats. Displacement AI use cases may be a big opportunity for startups to disrupt the incumbents.

.png?width=1024&height=512&name=AI%20may%20follow%20the%20Gartner%20Hype%20Cycle%20(2).png)

While displacement products may represent the biggest opportunities in AI entrepreneurship, the market isn’t ready for them. Advantage incumbents.

I suspect many founders attempted the concepts behind Uber, Stripe, and Snowflake years before these companies were actually founded. There is a market-readiness aspect to entrepreneurship. You can’t be too forward-thinking, as it may take 5 or 10 years before the market is ready. You also cannot be too iterative, as the technology may become obsolete within 6 months. Instead, envision the big company opportunity 10 years from now and determine the opening niche product or use case that both the market is ready for now and serves as a foundation to pursue the big vision in the future.

Jeff Bezos and the founding of Amazon may be a fair example. Bezos set out to build the largest web commerce company in the world. However, he didn’t start by selling everything to everyone. He started by selling books. At the time, consumers were uncomfortable buying most products online, as they were used to physically touching and inspecting a product as part of the purchase process. But buyers do not need to “touch” a book to be comfortable buying it. The product and quality are predictable. Books also had other advantages like global demand, low unit prices, and millions of SKUs. Bezos chose a brilliant opening product the market was ready for and used that success to expand into new products and offerings as the market matured.

To illustrate this dynamic in go-to-market, let’s look at opportunities in SDR AI tech. Most AI entrepreneurs attacking this space today are attacking with what I would call a feature rather than a product. For example, one startup allows SDRs to type voice mails and use AI to create an audio version that replicates their voice. That technology is really cool but I doubt it will become a big company on its own a decade from now. On the other hand, a few daring entrepreneurs are attempting the SDR displacement value proposition. That’s a big vision. However, the market is not ready for it. Most companies are not even ready for some of the co-pilot tech. Founders looking to build a big AI company will need to envision the displacement platform but find the initial co-pilot use case that the market is ready for today and serves as a foundation to pursue the big vision in the future.

Good AI models need good data. The large incumbents have it. The startups don’t. Advantage incumbents.

In the world of go-to-market tech, data historically surfaced as an advantage for a vendor in the form of switching costs. The longer a customer used the product, like a CRM, the more data accumulated and the more difficult it was for the customer to switch to a competing product, potentially losing the historical data and resulting insight that accumulated. Over time, that advantage was reduced by better export/import technologies.

In AI, data has a much larger value. Entrepreneurs need data to build their models. They don’t have the data. The incumbents do. Advantage incumbents.

To mitigate this issue, startups may increase their likelihood of success by targeting AI models that need data the incumbents don't have. The incumbents have the data that enables AI models for cold outreach, forecasting, account selection, etc. However, the large incumbents do not have as much data around discovery call execution, sales coaching, and marketing strategy formation.

[Great AI Engineers + Modest Sized Data] > [Enormous Data Set + Mediocre AI Engineers]. Advantage startups.

Companies pursuing AI tech want the best AI engineering talent to develop the models plus the most elaborate dataset to train the models. However, it will likely be difficult to get the best of both worlds. The incumbents have the most data today, as covered above.The attacking startups will likely end up with the best AI engineers. Top AI engineering talent is a scarce resource. They know they are good. They would rather make themselves rich and pursue the projects they want to pursue than make incumbent executives rich and pursue the projects the corporate strategy teams instruct them to pursue.

So who wins? The incumbents with B- AI tech talent but trillions of data points or the startup with A+ tech talent and millions of data points? Operators with the most experience building models say the industry is overestimating the advantage of “breadth of data." They believe the A+ team with less data will win. If they are right, advantage startups.

The most prominent buyer sentiment in the market today is not extracting efficiencies from AI but expressing concern over data privacy. Advantage incumbents.

How will our data be used?

Does AI violate our user agreements?

Our customer data is an important part of our intellectual property strategy. Does AI jeopardize that positioning?

These questions are top of mind for potential AI customers, especially large ones. These prospective customers are more likely to trust their data with existing vendors whom they have had long relationships with.

One caveat to this point requires a look back to 2002 when a similar narrative existed with the rise of cloud computing that gave the incumbents a false sense of security. CTOs blocked most moves to the cloud due to privacy concerns with their data residing outside of the network they controlled. However, over time, the cloud attackers addressed those privacy concerns and demonstrated massive ROI examples that eventually mitigated that posture. We could speculate a similar outcome.

Proprietary data acquisition becomes a critical function for AI startups

While we previously hypothesized that the best AI tech talent is more important than enormous data sets, there does exist a minimum data threshold needed to train the models. Acquiring that data will become a critical competency for startups. A few early approaches have already surfaced:

- Build a generic model based on public data and customize the model for each customer’s unique data. This approach overcomes the data privacy debate mentioned earlier. However, many customers may have limited volumes of data to yield an accurate model custom to them.

- Strike an exclusive partnership with a company with proprietary data. This strategy could especially be beneficial in non-tech industries that have extensive proprietary data but don’t have the know-how to attract and mobilize tech talent (i.e. credit bureaus, grocery stores, and insurance companies). This strategy also presents an opportunity for these traditional businesses to capitalize on the AI disruption. The issue is both the data provider and the AI developers think they are the most important piece and, hence, deserve more.

- To offset #2, a strong business development arm within an AI company could attempt to aggregate multiple data providers into a single partnership, creating a significant moat on the use cases that could evolve from the synergistic entity.

Go-to-market teams prefer vendor consolidation versus expansion. Advantage incumbents.

We have seen an explosion of go-to-market tech over the last decade, yielding teams with confusion, redundancy, and disparate data sets. They crave consolidation rather than expansion of their vendor roster. The general buyer sentiment is focused on testing the modules their current platform providers roll out before running tests on new entrants. Advantage incumbents.

Startups selling to startups led to past bubbles and bursts. In the case of AI, startups selling to startups may accelerate the disruption.

There is evidence that AI can already outperform some knowledge worker jobs. If AI can evolve to outperform, for example, insurance underwriters, commodity traders, radiologists, or sales development reps, it might be easier to start a company from scratch to fully exploit those technical advantages than pivot and embrace them as a large incumbent.

For example, if a large insurance carrier discovers that AI can more accurately underwrite an insurance policy than all of their human underwriters, the large carrier still has enormous cultural, political, and operational change management obstacles to fully capitalize on the technology. An AI-first insurance carrier will likely be able to get to the optimal organizational and operational design in a post AI world faster. Should this new crop of attacking startups surface, they could be an attractive new market for the AI tech enablers to target. Advantage startups.

That said, this narrative sounds starkly familiar to the “New Economy” mantra in 1998, claiming all brick and mortar companies would be quickly overtaken by the newly formed Internet attackers. That mantra was a major contributor to the 2001 crash. The “new economy” disruption did eventually occur in many sectors but it took time and occurred during the “slope of enlightenment” versus the “hype” phase of the Gartner Hype Cycle.

History. Advantage startups.

Only 1 out of 10 companies in the Fortune 500 list in 1955 are still in the list today.

Most of the CRM market share in 1995 was held by Siebel and ACT. I don’t know any companies using those technologies today. They are out there. I just don’t know any.

Technological innovations have not historically favored incumbents. They present an advantage for startups.

Conclusion

Who knows how it will play out? The above points are simply the dominant narrative today. My main advice. Be a player, not a spectator. AI will likely reshape the job you have today. Be part of that reshaping process. Don’t sit on the sideline.

.png?width=760&height=550&name=Startup%20Versus%20Incumbent%20(2).png)