The first investor meeting is a critical moment for any founder. The stakes are high, and the nerves even higher. Investors are looking for companies with the greatest potential, and founders are striving to make the perfect impression. But finding the right investor in the early stages of your company can set the tone for everything that follows. As a Partner at Stage 2, I’ve worked with countless founders, and have seen firsthand how the way a relationship starts can shape everything afterwards. The reality is the founder-investor relationship is a long one, so it's important to make sure it's built on strength and trust. After all, you wouldn’t marry someone after a first date, and choosing an investor—or an investor choosing you—shouldn’t happen overnight either.

In this article, I’ll share insights on what I look for in the initial stages of an investor relationship, how to craft a compelling introduction, and how to prepare for those all-important first meetings.

Establishing the Relationship: The First Investor Email

The Importance of a Personalized Approach

The first interaction between a founder and an investor often comes through an introduction, a cold email, or a networking event. In my experience, I always recommend a warm introduction as the first path to take when seeking investment.

As you start identifying the VCs you want to get in front of, start by understanding what their history of investing is in your segment or industry, and leverage your network (whenever possible) to secure that crucial initial introduction. While cold emails and direct outreach aren't dead, they are definitely a tougher route. Just as you would tap into your network during a job search, the same strategy applies when seeking out investors.

If you are cold emailing, my advice for the initial outreach is to be human and personal. If an email feels like it’s a generic mass email, it’s an immediate turn-off. If a founder hasn't taken the time to tailor their outreach, then it’s unlikely it’s going to be a good fit.

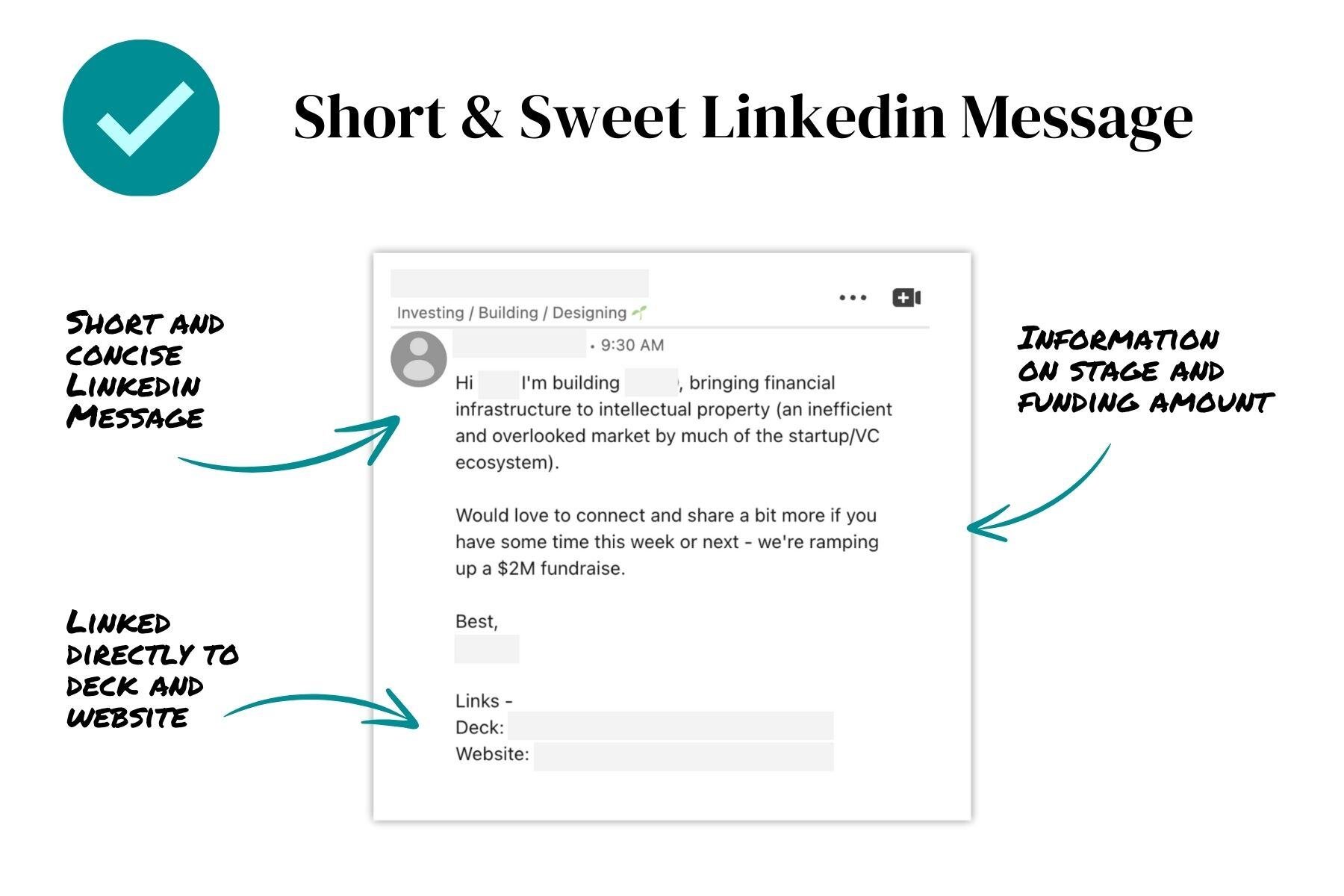

What does this look like in practice? I scoured my inbox and found a couple of great examples of emails that hit the mark. The good news is that these examples are not complicated. When in doubt, keep it simple, focus on getting the point across quickly, and answer "why should I care?”

Regardless of how we connect, it’s important to carry this personalized approach into the first meeting and beyond. When founders take the time to understand my investment focus, it shows they are serious and committed. Founders should expect the same from their investors—ensuring that they understand what the founders are building.

Beyond personalization, here are some of the top elements that I look for in an initial outreach:

- Clarity and Conciseness: Don’t bury the lead. The email should clearly explain what your startup does and why it matters within the first few sentences. If the details are buried, they’re likely to be overlooked. Imagine you’re talking to someone in an elevator—you only have a few seconds to capture their attention and make your case, so make every word count.

- Relevance: Highlight why you’re reaching out. If you have a mutual connection - of course mention that early on. But think about how your company aligns with the investor’s portfolio or interests. Do some research to better understand what those are and then quickly summarize that in a bullet point.

- Value Proposition: Why do you exist? Make this very clear and easy to understand. Your core value proposition should be concise and compelling. If you can’t articulate it in a short email, it’s unlikely others will grasp it either.

The First Investor Meeting: How to Make it a Success

During our first meeting or conversation, I look for several key elements to gauge whether there’s potential for a long-term partnership. But before getting into what should be in your deck, let’s talk about preparing for that initial meeting.

We all know that Zoom fatigue is real, which is why I like to (whenever possible) hold that first meeting in person. Investors evaluate a wide range of factors when deciding which companies to invest in, but one of the most important is the founder themselves. It makes a big difference when you can put a face to the name.

When starting the meeting, I suggest beginning without slides and focusing on the conversation. Know your story inside and out, and be able to tell it naturally without relying on a set of slides. The goal is to build a relationship, so avoid jumping straight into pitch mode. Instead, focus on making a connection and establishing trust. What goes into a pitch deck can vary, but here are some key areas that you should focus on:

- Why the Company Was Started and Current Status: I’m always curious about the motivation behind the startup. Understanding the “why” gives me insight into the passion and drive of the founders. I’m also interested in where the company stands today and where the founders see it going in the future.

- Market Opportunity and Future Vision: A clear definition of the market and its potential for growth is essential. I’m looking for startups that not only have a great product but are also targeting a market ready for disruption or innovation.

- Product and Customer Focus: Understanding the initial product offering, the target customer base, and the competitive landscape helps me assess the startup’s potential to carve out a niche in the market.

Reflecting back on some of the early conversations we had with our portfolio company Slang, I've pulled two slides they shared during our initial discussions which are good examples of how to articulate the problem and pain point that leads to their solution.

What do I see that is often overlooked in the investor pitch?

- What’s working? As an investor, I’m naturally interested in the numbers, projections, and the big vision. But what’s equally important—and often overlooked—is what’s happening on the ground. I want to know what’s working from a go-to-market perspective, what your customers are saying, and how you’re acquiring those customers. It may feel too tactical, but investors like to understand how your message is landing in the market. Also, don't forget to talk about your product and how it actually works. Many times founders are so focused on the big picture that they overlook some of the most obvious elements.

- Why Now? This one is all about timing and it’s one of the most important aspects I consider. Why is now the right time for your product or service? Whether it’s new technology, a shift in consumer behavior, or a regulatory change, articulating why this is the time to be building this company makes you stand out. This demonstrates an understanding of the broader market dynamics that could make or break their success.

- Who are you solving a problem for? I often talk with founders who claim they’re solving a problem for everyone. They envision dominating a whole market (which comes in time), but as a startup, you must be focused on understanding who you are a fit for—and, more importantly, who you are NOT a fit for. Being clear about this gives me confidence as an investor that you’ve done the work to identify your ideal customer and understand why that focus matters.

What should you leave out? Don’t feel pressured to force a hockey stick financial projection into your revenue plan and resist the urge to manufacture charts or quadrants that conveniently place your company in the top spot while pushing competitors to the side. Be honest about what you expect to see over the next five years. These initial meetings are all about building trust, and bringing an inflated and overly optimistic revenue plan to the table is a quick way for investors to lose confidence in you. I’d much rather see a founder present a realistic plan than one containing unfounded claims.

Lastly, remember that finding the right investor to work with—and vice versa—is a relationship that develops over time. The best time to start building these relationships is before you need to, well before you're in full fundraising mode. That coffee or LinkedIn connection might just be the key to unlocking a truly powerful investor relationship down the road.