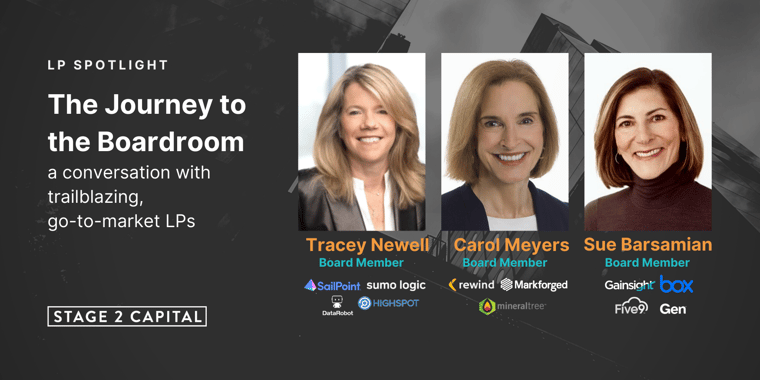

Sue Barsamian, Tracey Newell, and Carol Meyers have some special commonalities — they’re all former go-to-market executives, prominent Stage 2 Capital LPs, and board members at a combined 27(!) public and private companies.

They recently sat down with Stage 2 Capital Operating Partner, John Boucher, to share more about their journeys, and describe what it takes to pursue boardroom opportunities.

What specific characteristics, skills, and experience qualified you for your first and subsequent board roles?

As a former sales executive, Tracey is predominately approached by companies that can leverage her go-to-market knowledge and experience.

"I tend to work with hyper-growth companies — many of which have a product-focused CEO, and need an outside perspective as they think about scale," Tracey says. "They've come to the realization they have met a critical market need and a growing customer base, and they want to step on the gas — that's when they will ask me to join." Tracey says.

How do you choose what type of board to join or pursue?

“A lot of people say they want to join a board because it’s an end-state,” Tracey says. However, she thinks of boards like operating roles, and asks herself, “Would I want to work at this company, do I believe in the market, its CEO, and its industry? Do I see a 3-5 year path that’s not complicated?”

Sue adds, “The boardroom is a very different world from that of an operator. The more you learn, the more focused you get and the easier it is to find a board or category that’s right for you.” Sue was also very prescriptive in what she was looking for, choosing companies that were “Only in growth mode, within SaaS or Cybersecurity, and located within the Bay Area.”

What are some of the most challenging problems or topics you have faced as a board member? How did they get resolved?

“Acquisitions are certainly a big issue, where board dynamics become very important because everyone is trying to do what’s best for the company, for the shareholders, etc.,” Carol says. “I was working with a private company that had a good offer come in, and the executive team wanted to take it. The board really clung together and after many conversations, we helped them realize they could do better, and ended up more-than doubling the first offer.”

She adds, “Another dicey issue is a CEO leaving, or a founder-to-CEO transition. People worry when a founder leaves, and there’s a lot of emotional hurt wrapped up in those topics. The board needs to step in with an objective view, determine what’s right for the business and team, and lower the temperature for the people involved, so that it’s a good outcome across the board.”

Describe the highest-functioning board meetings you are currently a part of?

“I love all of my boards. Box was my first board, and it’s very highly-functioning,” Sue says. “Over the years, we’ve spent a lot of time aligning and agreeing on how we want to look at the business. We receive a lot of pre-read material, and we pre-decide how many times a year we dive deep on go-to-market, product, cybersecurity, etc. This structure allows us to determine how much time we spend on key topics, and when to bring in external perspectives to provide third-party views.”

Sue goes on to say, “Board members with the most functional expertise in a certain area (finance and G&A, go-to-market, product and strategy, etc.) peel off and do a deep dive into respective plans for the next year. They’ll iron out questions before the meeting, and come to the boardroom with the ability to attest to what has already been vetted.

How has bringing more diversity to the boardroom positively impacted your boards, and how do you respond to the criticism implying that diversity efforts sacrifice competence?

“Having a group with diverse experiences and diverse backgrounds almost always leads to a more robust discussion and a better outcome,” Sue says. “I only join boards that are committed to this philosophy, while emphasizing a board member’s skills first.”

Carol shares, “Sometimes critics imply that because you’ve brought on women and persons of color, you weren’t looking at their skills. Boards are quite clear about needing members with the right experience and culture fit, and it’s their job to make the effort to search hard for the right candidates.”

Tracey adds, “I’ve been involved with diversity work since the 90s and have learned that it’s a really hard problem for technology companies. You have to focus on it to make a change. But, the more diversity you have, the better the minds you have approaching problem solving.”

What advice would you give to an operator seeking a board role?

"Go-to-market expertise is becoming a more standard part of a board member's skill set. Building your personal playbooks of driving go-to-market and navigating crises is incredibly valuable," Sue says. "The second part of it is C-Suite experience. The time to get on a board is not when you're a director — it's when you've sat in an executive role and have had boardroom exposure. You need to be able to help drive the strategy and governance of an entire company."

When it comes to more junior folks, Carol recommends seeking out advisor opportunities. "For those at a director level, there are a lot of growing companies looking for new advisors. Directors have more specialized knowledge, and becoming an advisor allows you to exercise your skills of understanding a new business, what their challenges are, and applying what you know to help them achieve their goals in a new way."