Your startup is ready to scale sales. But which demand generation channel should you choose? Should you lean into marketing, build an SDR team to cold call, engage channel partners, or all of the above?

As I prepared for our Go-To-Market Accelerator last summer, I did some research on this question with the hopes of finding an existing framework to reference in class. Surprisingly, I didn’t find much. Therefore, with the help of our Stage 2 Capital partners and LPs, I assembled the matrix below to guide founders and early go-to-market executions on this critical decision.

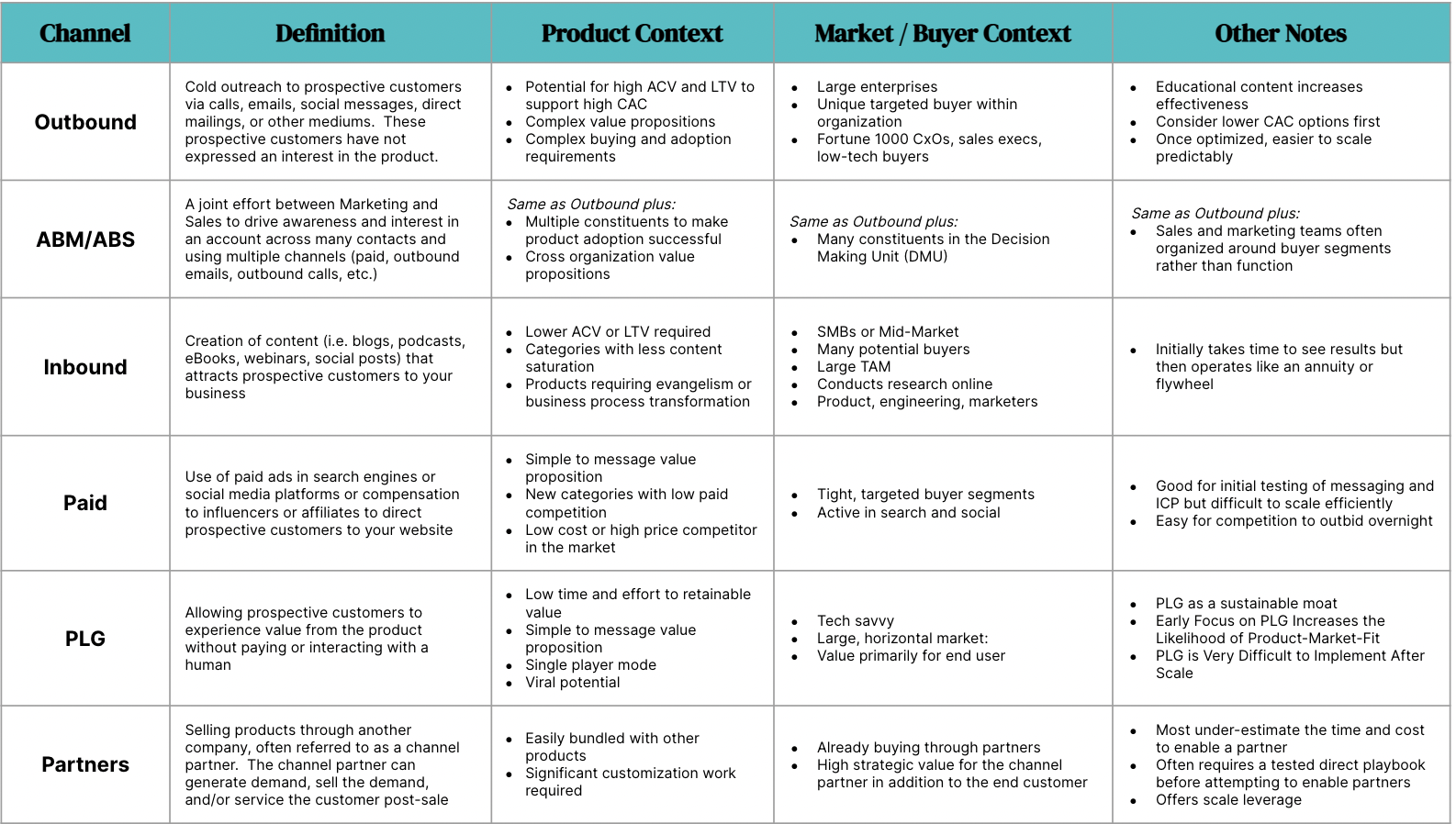

As is the case in most go-to-market system design questions, the optimal demand generation channel selection is dependent on your startup context. Primary contextual drivers fall into three buckets: (1) Product (what do you sell) (2) Market (to whom do you sell) (3) Stage (where is the company in its maturity curve). The matrix below is organized accordingly. A more detailed elaboration of the cited considerations are found in the body of this article.

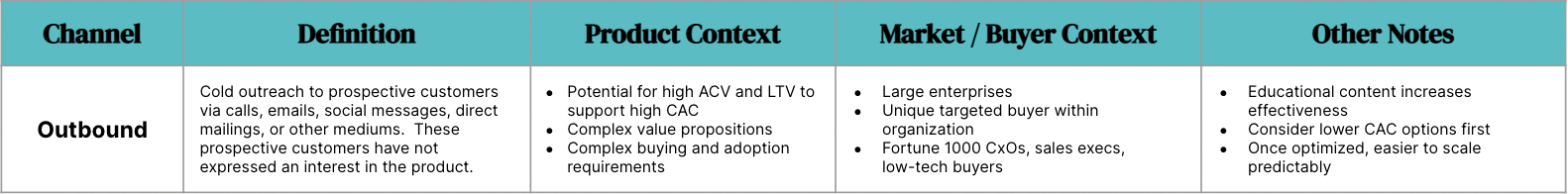

Outbound

Definition

Cold outreach to prospective customers via calls, emails, social messages, direct mailings, or other mediums. These prospective customers have not expressed an interest in the product.

Product Contexts Favorable for Outbound

- Potential for high ACV and LTV to support high CAC: Outbound is expensive. The channel typically requires a high amount of human capital to execute the activities needed to set appointments. Furthermore, the prospects are “cold” and have likely never heard of the business or perhaps even the category. This is especially true in a startup context. As a result, the ability to generate a high Average Contract Value (ACV) and Lifetime Value (LTV) is needed to offset the high Customer Acquisition Cost (CAC) and generate acceptable unit economics through this channel. Recent benchmarks suggest at least $10K ACV for outbound to be possible.

- Complex value propositions: It is very difficult to explain complex value propositions through low-touch channels like paid, inbound, or PLG. The “white glove”, human-centric aspects of outbound are helpful here.

- Complex buying and adoption requirements: Sometimes products are simple to understand but difficult to drive to a purchase decision and adopt. Buyers will expect a high-touch, personalized approach from the beginning as a dimension by which they choose a vendor.

- Product Context Examples:

- Enterprise HR Systems, Enterprise BI Systems, Finance Systems

Market/Buyer Contexts Favorable for Outbound

- Unique targeted buyer within organization: If your product is targeted for a unique role within an organization, like VP of DEI or Director of Open Source Security, it may be difficult to target and attract these users with other mediums.

- Fortune 1000 CxOs: These executives are in constant deflection and delegation mode. Their availability to conduct research or take exploratory meetings is difficult. High levels of personalization driven by significant efforts in outside-in analysis by the salesperson are required in the outbound messages. Often success means the CxO delegated down a first meeting to a powerful lieutenant that can evolve into your champion.

- Sales Execs: The sales team is the boundary function between their organization and the market. Compared to other functions, they tend to be much more engaged with their email, on social accounts, and attentive to their phone activity.

- Low-Tech Buyers: If the buyers do not spend much time online, it is difficult to get the other channel options to work.

- Market / Buyer Examples:

- Personas: Plumbers, corporate development professionals, real estate asset managers, etc.

- Companies: Restaurants, yoga studies, government offices, etc.

Other Notes

- Educational content increases effectiveness: Content, like blog articles, white papers, case studies, webinars, ROI studies, etc., make it easier for sales to generate frequent and engaging touch points with the buyer. Because most cold prospects are at the “Awareness” stage versus the “Decision” stage of the buyer journey, calls to actions to see a product demo are suboptimal. Instead, buyers are more responsive to content that helps them frame the problem, visualize the opportunity, or understand the category. [Side note: When outbound emailing to a prospect for the first time, be careful of including attachments and links as they can increase your likelihood of ending up in SPAM filters.]

- Consider lower CAC options first: Outbound is hard. On average, CAC is higher than the other channel options. Buyers are constantly adopting tools to keep outbound out. If you are on the fence, try another channel first.

- Once optimized, easier to scale predictably: If outbound starts to work across a few Business Development Reps (BDRs) or Sales Development Reps (SDRs), scale can be more predictable than other channels, assuming there is enough Total Addressable Market (TAM) to support the scale. For example, if a marketing team wrote a blog article every week and generated 50 Marketing Qualified Leads (MQLs) per month in 2022, it doesn’t necessarily mean that if they write 2 blog articles per week, they will generate 100 MQLs per month in 2023. However, if a team of 4 SDRs each called on 50 new accounts and generated 15 Sales Qualified Leads (SQLs) each month for a total of 60 SQLs across the SDR team, it is more likely that they can expand the team to 8 SDRs, provide each SDR with 50 new accounts each month, yield 15 new SQLs per SDR per month, and increase total SQLs per month from the SDR team to 120.

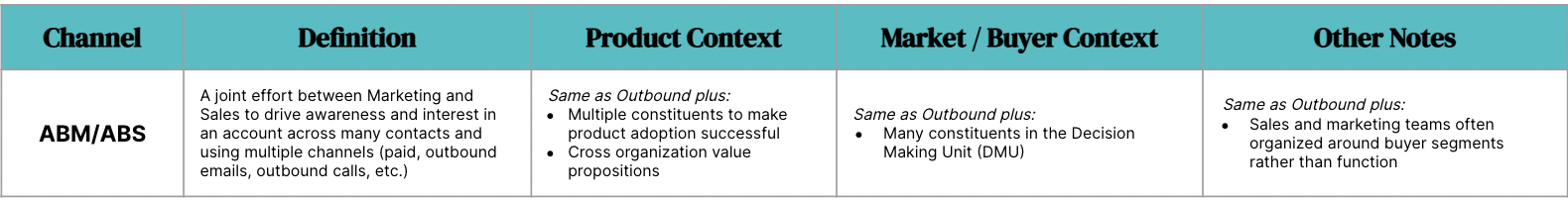

Account-Based-Marketing (ABM) / Account-Based-Selling (ABS)

Definition

A joint effort between Marketing and Sales to drive awareness and interest in an account across many contacts and using multiple channels (paid, outbound emails, outbound calls, etc.)

Product Contexts Favorable for ABM/ABS

Same as outbound, plus the items below:

- Multiple constituents to make product adoption successful: Successful product adoption requires resources from multiple functions (operations, security, IT, engineering). ABM/ABS can ensure these resources are engaged at the appropriate time in the buying process and can tailor the experience to the specific questions each function will have.

- Cross-organization value propositions: Horizontal value propositions with multiple department users will require a coordinated effort to tailor the messaging to each department and mobilize an internal movement to prioritize the value proposition.

- Product Context Examples:

- Collaboration tools, recruiting software, corporate governance software

Market/Buyer Contexts Favorable for ABM/ABS

Same as outbound, plus the items below.

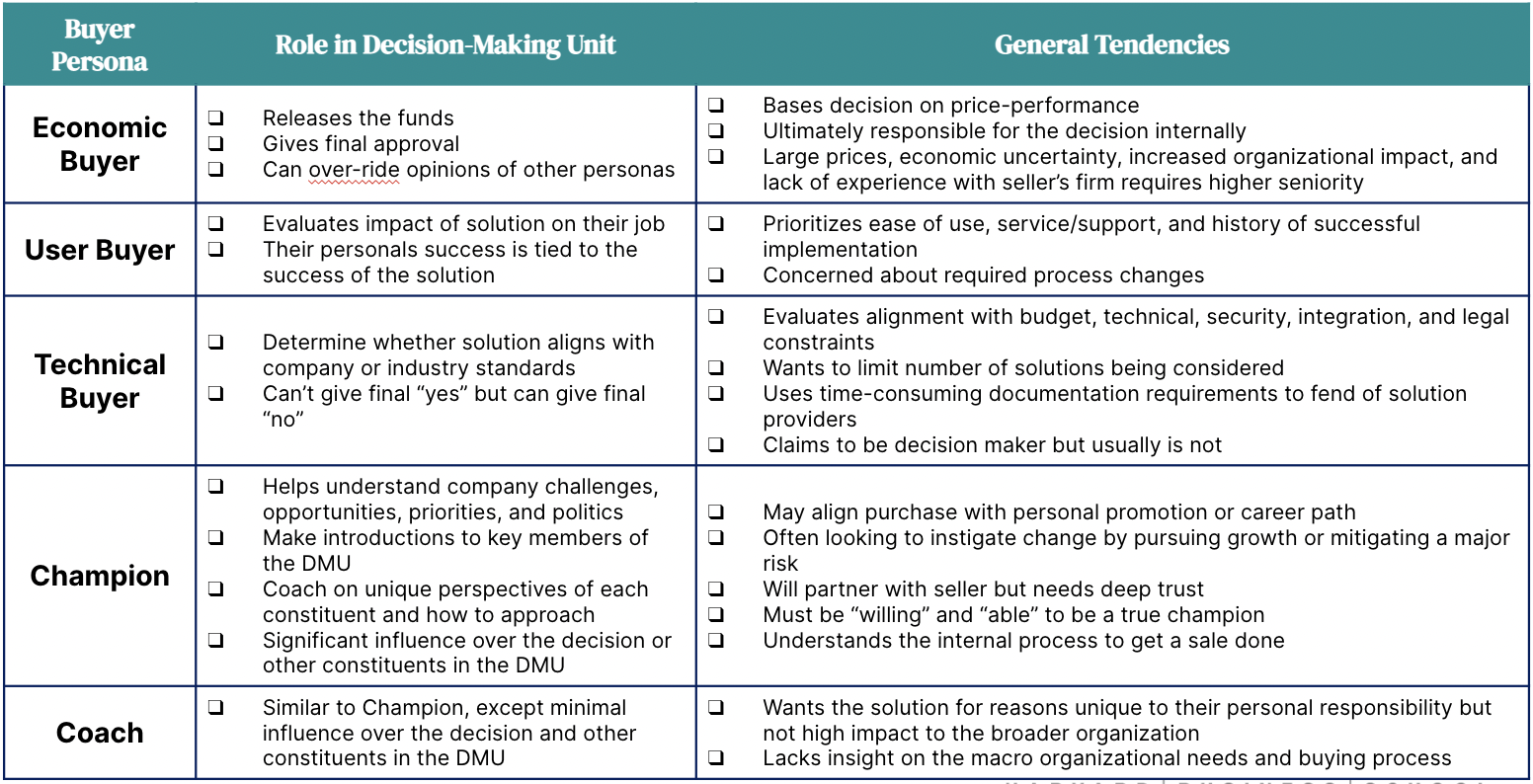

- Many constituents in the Decision Making Unit (DMU): The purchase requires buy-in from multiple constituents. The Decision Making Unit typically has an economic buyer, end user, business line owner, technical buyer, coach, and champion. Below is a generic overview of these roles:

- Market / Buyer Examples:

- Hospitals, large financial services, franchisees

Other Notes

Same as outbound, plus the items below:

- Best practice to organize sales and marketing teams around buyer segments rather than function: Cross-functional attribution, goal setting, and accountability are difficult in these complex buying scenarios. The last behavior you want to have happen is marketing discontinues focusing on an account just because an SDR set an appointment and any revenue from that account will be credited to the outbound SDR function and not marketing. In fact, once an SDR sets up a first appointment, marketing should be doubling down on the efforts with that account to drive momentum, and vice versa. One way to address this complexity is to organize cross-functional teams of SDRs, Account Executives (AEs), Account Managers (AMs), Customer Success Managers (CSMs), and a Demand Generation Marketer on a set of named accounts. This structure allows the organization to hold the cross-functional team accountable to a certain pipeline generation, sales, renewals, and expansions, empowering the team to use all resources to drive toward those goals.

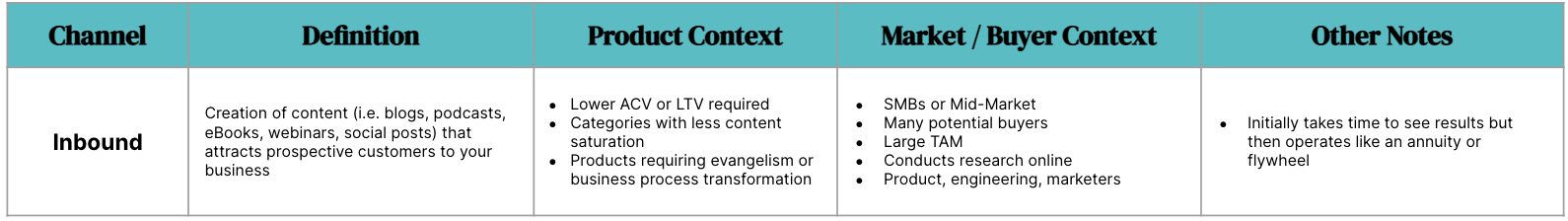

Inbound

Definition

Creation of content (i.e. blogs, podcasts, eBooks, webinars, social posts) that attracts prospective customers to your website and business

Product Contexts Favorable for Inbound

- Lower ACV or LTV constrain: If you intend to sell your product at a low ACV, you will need to do so with a low CAC to get the unit economics to work. Inbound typically yields a lower CAC because some phases of the buyer journey are completed with scalable educational content versus people. Furthermore, because salespeople are engaging only with prospects that have “raised their hand” and further down the buyer journey, sales cycles tend to be lower and close rates tend to be higher, also lowering overall CAC.

- Categories with less online content saturation: Some categories are very saturated with content already while other categories are not. It is easier to “break through the noise” if you are in a category where existing online content is minimal.

- Products requiring evangelism or business process transformation: Educating a market is time consuming and expensive. Leveraging scalable content alleviates those costs. Furthermore, evangelism of a new concept typically suggests lots of whitespace for the content to stand out.

- Product Context Examples:

- Conversational marketing, generative AI, SMB accounting software

Market/Buyer Contexts Favorable for Inbound

- SMBs or Mid-Market: Prior to the invention of the Inbound marketing channel, very few vendors targeted the SMB market because they couldn’t get the CAC math to work. The Inbound channel enables companies to lower CAC and offer their product at an ACV affordable to the SMB.

- Many potential buyers / Large TAM: More buyers in the market means there is more potential engagement with each piece of content you create. If there are only 1,000 potential buyers in the market, the ROI on content marketing will be difficult.

- Conducts research online: Most content created is digital in nature. If the buyer is not active online, they are unlikely to see the content. Exceptions exist where a company can create a study, publish a physical copy of it, and mail it to their buyers. However, this approach does not have the advantages of SEO, low cost distribution, content performance longevity, and clearer attribution that digital mediums have.

- Leaders in product, engineering, marketing: Product and engineering leaders like to do their own research, don’t have phones, live in tools besides email, are internally focused, and tend to be introverted. Therefore, outbound and ABM/ABS tactics are difficult. Marketers have large budgets and are cold called often. It is difficult to break through the noise. Like product and engineering, they prefer to research on their own than engage with an end-to-end sales process.

- Market / Buyer Examples:

- Web design shops, IT consultants, security teams, small business owners

Other Notes

- Initially takes time to see results but then operates like an annuity or flywheel: Few companies will see much lift in the first month of effort with Inbound. However, months in, impact will become substantial and will sustain and grow. Research shows 90% of new leads generated by a company in a month originates from content created over 3 months ago, and sometimes years ago. If you get rid of your outbound team, you won’t generate any outbound appointments. If you get rid of your inbound team, the existing content will continue to yield new leads.

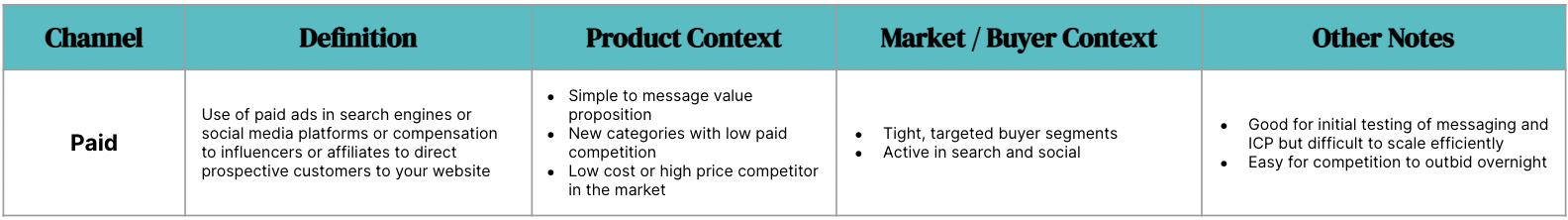

Paid Digital

Definition

Use of paid ads in search engines or social media platforms or compensation to influencers or affiliates to generate leads

Product Contexts Favorable for Paid Digital

- Simple to message value proposition: Most paid ad mediums are limited to a few lines in an ad or a few seconds of a video. Therefore, simple to understand value propositions are required.

- New categories with low paid competition: Paid digital is very competitive, often driving the cost per click, cost per lead, and cost per sale to a level where profitability is not possible. New categories may not have substantial competition yet. This advantage may be temporary.

- Low cost or high price competitor in the market: If your company can develop your product or deliver your value cheaper than the competition, then you can tolerate a higher CAC and still generate a profit where your competition cannot. Similarly, if you can command a higher price than your competition, then you can tolerate a higher CAC as well. Your ability to tolerate a higher CAC than the competition allows you to pay a higher price per click on ads where your competitors cannot afford.

- Product Context Examples:

- Neo-banks, survey tools, productivity tools

Market/Buyer Contexts Favorable for Paid Digital

- Tight, targeted buyer segments: Digital ad platforms enable high degrees of segmentation and targeting (i.e. only show my ad to people who like birdwatching, aged 50 and over, and based in the U.S. northwest). Other channels cannot deliver that level of precision and scale. The ad platforms can often yield more accurate and updated targeting than say purchased lists for outbound marketing.

- Active in search and social: It is difficult to get their attention if the buyer is not already on the platforms where the ads are

- Market / Buyer Examples:

- Sustainability directors based in EMEA, procurement directors in the chemical industry

Other Notes

- Good for initial testing of messaging and ICP but difficult to scale efficiently: Paid digital has a bad reputation for high CAC and low scale potential. That reputation is deserved. However, many founders overlook the cost effectiveness to learn in paid digital. What buyer segments are best for your product? What messages resonate best with each buyer segment? Which call to action generates the highest conversion from visitor to lead on our website? These questions are a small sample of key strategic decisions that can be answered ten times faster using paid than any other demand generation channel. Would you pay $20,000 to understand the answers to these questions in a week via paid digital rather than waiting 6 months through another channel (and realistically spend the same amount of money in human effort over that timeframe)?Few founders and early demand generation leaders appreciate this opportunity.

- Easy for competition to outbid overnight: Unlike other channels, the competition can see where you are advertising, the copy you are using, and often estimate the price you are paying. Competition can copy and outbid your positions almost overnight.

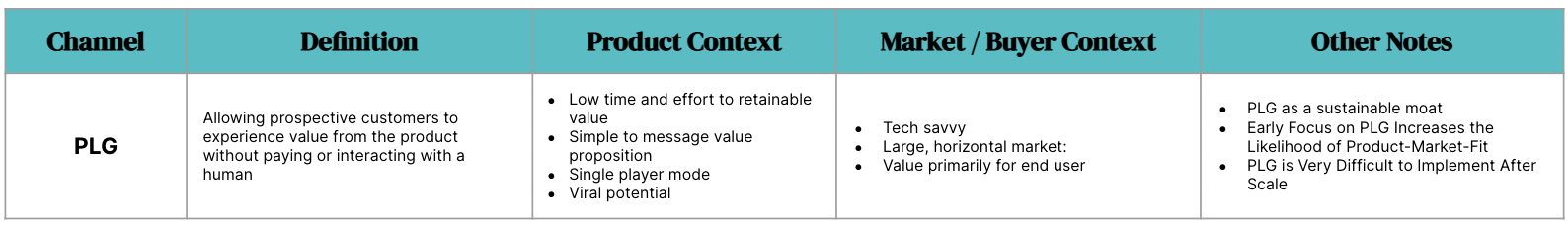

Product-Led Growth (PLG)

Definition

Allowing prospective customers to experience value from the product without paying or interacting with a human

Product Contexts Favorable for PLG

- Low time and effort to retainable value

- Low time: Users see the value in minutes

- Low effort: Users realize the value with little work on their part

- Retainable value: The value use case is on-going rather than one-time.

- A value proposition that has current demand versus one that needs to be evangelized: PLG, by design, means the user becomes aware of, activates, and adopts the product without human intervention. Simply offering a free version of an established or known category is easier to message with this constraint.

- Potential for virality: I’m not convinced PLG needs virality. PLG needs a low cost acquisition medium, one of which can be virality. Organic virality is more powerful than incented virality. Organic virality exists if the virality occurs through the normal usage of the product (i.e. when a Docusign user sends a signature request to a non-user). Virality is more powerful when the viral behavior transcends corporate boundaries versus if it is limited to within the company (i.e. Calendly). It is also powerful when it drives a network effect, meaning each additional person that joins increases the value for everyone else.

- Product Context Examples:

- Backup and storage, anti-virus, electronic signature, calendar sharing

Market/Buyer Contexts Favorable for PLG

- Large, horizontal market: Even the most successful PLG companies have reasonable user disengagement at each stage of the funnel (awareness, activation, retention, monetization). A large market is needed to support growth within the context of this funnel leakage.

- Tech savvy user: Users that are technical are more likely to find the product online and substantially more likely to be able to set up and adopt it without assistance.

- Value primarily for the end user: PLG requires adoption by the end user before purchase. Therefore, if the value is primarily for the executive, the end user is less likely to adopt the product before the organization purchases it.

- Market / Buyer Examples

- Designers, engineers, product managers

Other Notes

- The Hidden Power of PLG: Sustainable Moat Development: PLG presents an opportunity that is rare in B2B software, the creation of a sustainable moat. In traditional software, we build a product, hope that it takes off, and increase our prices as the brand and category matures. However, we are always at risk of a group of talented engineers in Silicon Valley disrupting us with a similar product offered at a lower price. My sustainable moat test is the following question: “Imagine a talented group of engineers formed a team, raised a big round from Sequoia, reverse engineered your product, and charged half your price. Why do you still win?” PLG presents a disruptive business model advantage for the attacker and substantially decreases disruptive risk for the defender. It’s very difficult to undercut price if the opening use case costs $0. By the time the user’s economic buyer gets involved, the selling organization has created tremendous switching costs. For example, Box could walk into the CTO of Fidelity’s office checking off the CTO’s needs of geographic redundancy and role permissions. But Dropbox could walk in and say “30,000 of your employees use our product every day. We just want to help you secure the usage to meet Fidelity’s standards”. PLG organizations also benefit from economies of scale. PLG provides R&D teams with tremendous user volume to experiment, learn, and iterate product features and user experiences. If PLG is possible in your category and you do not pursue it, someone else can. Unless the defending company has created a true sustainable advantage, or “moat”, then there will be a forever risk of disruption. For these reasons, I encourage startups to explore the applicability of PLG to their category.

- Early Focus on PLG Increases the Likelihood of Product-Market-Fit: Many B2B startups jump prematurely to defining revenue as the organization’s north star before proving the product consistently generates value for the target customer. A PLG go-to-market model puts product value at the forefront of the organization’s focus, increasing the likelihood of PMF as a precursor to scale.

- PLG is Very Difficult to Implement After Scale: There are a number of unicorns who have implemented PLG out of the gate and then layered an enterprise team on later (i.e. Slack, Dropbox, Asana, etc.). However, while I can think of many companies that tried to add PLG after reaching $10M in ARR through a sales-led model, I can’t think of anyone that succeeded. The reasons for failure in these situations are twofold: (1) Unwillingness for the organization to put enough value into the free version of the product for fear of cannibalizing the current revenue stream. (2) Poor selection of an optimal temporary “sandbox” for the growth team to experiment and learn in while minimizing impact to the core business model. The key takeaway: time is of the essence. If you are at the seed stage, think twice about waiting until you hit a few million in ARR before attempting PLG. The odds of success become significantly lower at that point. It should also be comforting that if you attempt PLG and find that it is not feasible in your category, you are left with a very easy to adopt product and an extremely low friction user acquisition funnel. That’s a pretty good foundation to transition to a sales-led growth model.

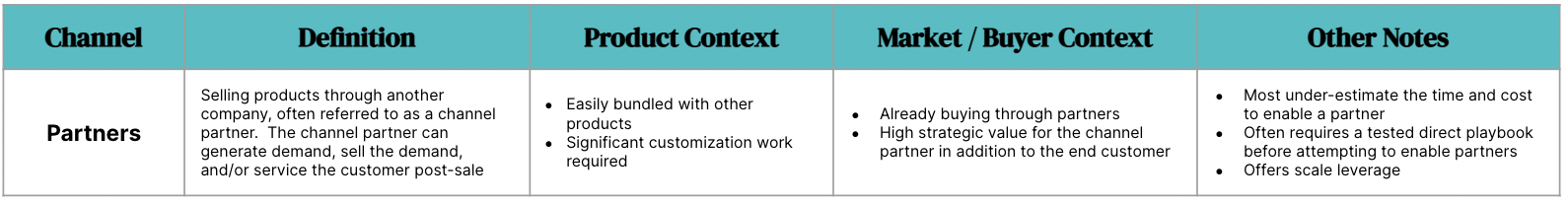

Partners

Definition

Selling products through another company, often referred to as a channel partner. The channel partner can generate demand, sell the demand, and/or service the customer post-sale

Product Contexts Favorable for Partners

- Easily bundled with other products: Allows the partners to add value by bundling your product into an overall package of tools for the end customer

- Significant customization work required: Allows the partner to generate an attractive margin by offering to do the customization work

- Product Context Examples:

- Products that integrate with custom tech stacks, child care benefits, VOIP phones, D&O insurance

Market/Buyer Contexts Favorable for Partners

- Already buying through partners: If buyers already have relationships and trust partners for guidance on purchases in your category, that relationship can be leveraged to drive your product.

- High strategic value for the channel partner in addition to the end customer: Your product could provide a “missing piece” in the channel partner’s overall offering or may address a common objection that is stalling deals.

- Market / Buyer Examples:

- IT, security, HR

Other Notes

- Most founders under-estimate the time and cost to enable a partner: Building a direct sales force is expensive and scary for most founders. It is so intriguing to simply engage the sales team from a partner and provide them with a percentage of the sale. However, enabling a channel partner is much more involved than most founders expect. It requires understanding the strategic priorities of the leadership team and how your product can help drive them. Then, once leadership is bought in, it requires a strategy on training and incenting the front line salespeople to want to learn your product and bring it up during the scarce face-time they have with customers.

- Often requires a tested direct playbook before attempting to enable partners: The other issue with using partners initially is, at this stage of the business, you rarely have your sales playbook optimized. You need to progress through the test/learn/iterate cycles to optimize your specific Ideal Customer Profile (ICP) and Customer Value Proposition (CVP). These test/learn/iterate sequences are very difficult to execute through a channel partner as the salespeople don’t work directly for you and you often have minimal exposure to observe the conversation with the customer. Even if you intend to scale long term through partners, it is advisable to start with a channel that you have direct control over and access to in order to facilitate these learning cycles.

- Offers scale leverage: Once you successfully enable a channel partner, it can be quite scalable, especially compared to other channels. As channel partners grow their sales team, you often see growth in sales from the partner. You can also leverage the processes and collateral used to enable the first partner to enable additional partners. Partners don’t always have demand generation: As mentioned earlier, partners can be used to generate demand, sell or service customers. Not all channel partners have potential or desire to drive demand for you.

Which demand generation channel is best for your startup? There is no universally correct answer. The optimal decision is contextual. While many organizations end up with a multi-channel organization over time, the first attempt is critical. I hope this article helps you frame your startup context and get the decision right out of the gate.